Warning: Zend OPcache API is restricted by "restrict_api" configuration directive in /srv/users/serverpilot/apps/goldoildrugs/public/wp-content/plugins/tubepress/vendor/tedivm/stash/src/Stash/Driver/FileSystem.php on line 253

Warning: Zend OPcache API is restricted by "restrict_api" configuration directive in /srv/users/serverpilot/apps/goldoildrugs/public/wp-content/plugins/tubepress/vendor/tedivm/stash/src/Stash/Driver/FileSystem.php on line 253

Quotes of the day:

Drugs are not always necessary, but belief in recovery always is.

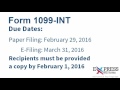

Form 1099-INT is the IRS tax form used to report interest income. The form is issued by all payers of interest income to investors at year end. It includes a breakdown of all types of interest income and related expenses. Payers must issue a 1099-INT for any party to whom they paid at least $10 of interest during the year.

We uses YouTube API Services.

Click to rate this post!

[Total: 0 Average: 0]