Warning: Zend OPcache API is restricted by "restrict_api" configuration directive in /srv/users/serverpilot/apps/goldoildrugs/public/wp-content/plugins/tubepress/vendor/tedivm/stash/src/Stash/Driver/FileSystem.php on line 253

Warning: Zend OPcache API is restricted by "restrict_api" configuration directive in /srv/users/serverpilot/apps/goldoildrugs/public/wp-content/plugins/tubepress/vendor/tedivm/stash/src/Stash/Driver/FileSystem.php on line 253

Quotes of the day:

The historical crusades against Muslim lands, the colonization of Spain by the Muslim Moors and India by the British were all driven by economic interests, despite the advertised reasons that were used to mobilize their armies at the time. In my opinion, the invasion of Iraq was not about spreading democracy or weapons of mass destruction, it was about the oil.

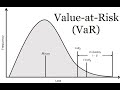

Value at risk (VaR) is a statistic that measures and quantifies the level of financial risk within a firm, portfolio or position over a specific time frame. This metric is most commonly used by investment and commercial banks to determine the extent and occurrence ratio of potential losses in their institutional portfolios.

We uses YouTube API Services.

Click to rate this post!

[Total: 0 Average: 0]